- Adri Nieuwhof, Electronic Intifada, 27 October 2009

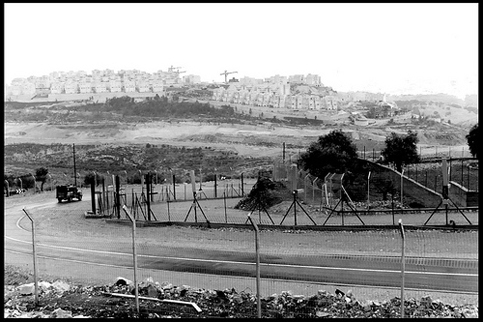

Photo: Scott Weinstein Israel’s wall next to Har Homa settlement in the West Bank

Several Western pension funds and financial managers hold shares in two Israeli banks: Bank Hapoalim and Bank Leumi. Both banks operate in and offer loans to finance illegal settlement activities in the occupied Palestinian and Syrian territories.

Bank Hapoalim, Israel’s largest bank, was established in 1921 by the Israeli trade union Histadrut and the World Zionist Organization. It was nationalized in 1983 but privatized again in 1996. Founded in 1902 and originally named the Anglo-Palestine Bank, Bank Leumi is Israel’s second-largest bank. Both banks have branches in the settlements of Gilo and Pisgat Ze’ev, located in the occupied West Bank. Bank Hapoalim also has branches in the Ramot settlement in occupied East Jerusalem as well as the occupied Golan Heights. Meanwhile, Bank Leumi maintains branches in the settlements of Ma’ale Adumim, Oranit, Kiryat Arba, all in the occupied West Bank, and Katzrin in the Golan Heights.

Israel’s settlements in the Occupied Palestinian Territories (OPT) and the Syrian Golan Heights violate the Fourth Geneva Convention, which prohibits the Occupying Power to deport or transfer parts of its civilian population into the territory it occupies. Therefore, the local branches of the two banks in these settlements are illegal as well.

Bank Hapoalim and Bank Leumi are involved in other violations of international law by providing mortgages to settlers for the purchase of property in the settlements. On 12 July 2009 the Israeli newspaper Makor Rishon reported that Bank Hapoalim provides mortgages throughout the country, including in the occupied West Bank. The newspaper also revealed that a Jerusalem branch of Bank Leumi offered mortgages to purchase homes in Israeli settlements without any issues. Indeed, Bank Leumi’s willingness to assist settlers in buying property is also openly advertised on a billboard in Zufin settlement. Zufin was built on land seized from the Palestinian village of Jayyus, located in the West Bank.

For the Zufin View Project, plots for private construction are for sale with special offers for mortgages by Bank Leumi, as advertised on billboards. By lending money for the purchase of houses in illegal settlements, Bank Hapoalim and Bank Leumi are facilitating the transfer of the Israel’s civilian population into occupied territory, contrary to international law.

The two banks also offer credit for settlement construction projects. Digal Investments and Holdings, an Israeli construction and real estate company, is developing a gated community in the Nof Zion settlement located in occupied East Jerusalem. Bank Leumi extended credit to Digal for the construction of 287 housing units, a synagogue and a shopping center in Nof Zion. Research conducted by Who Profits from the Occupation? revealed that Bank Hapoalim is also involved in settlement construction, two projects in Ma’ale Adumim and one in Har Homa. The construction of settlements is a violation of international law.

Bank Hapoalim also supports the development of Israeli business in industrial zones located in the West Bank. Built on expropriated Palestinian land, the industrial zones are contrary to international law. The jobs offered by the companies in the industrial zones serve to attract Israeli civilians to live in the settlements. However, the waste produced in the industrial zones pollutes nearby Palestinian agricultural lands, threatening the environment and public health in the West Bank. In the last two years, Bank Hapoalim provided loans to five Israeli companies (Doron Furniture, Ronopolidan, Ram Quality Products, Ewyg Advanced Technologies and Tzarfati Metal and Vehicle Services) operating in the West Bank industrial zones of Barkan and Mishor Adumim.

Both banks have also lent money to the City Pass consortium. City Pass holds the contract with the State of Israel for the construction of a light rail project that will connect Jerusalem to several illegal settlements. The funding agreement for the City Pass consortium with the two banks includes short-term loans totaling $420 million and long-term loans valued at $100 million. Because it contributes substantially to Israel’s occupation of the West Bank, two French companies involved in the light rail project, Alstom and Connex (a subsidiary of Veolia Transport), have come under pressure to withdraw from their contracts.

Both Bank Hapoalim and Bank Leumi have relationships with European and American financial institutions and fund managers. For example, two major Dutch pension funds, ABP and PGGM/PFZW, and the Norwegian Government State Pension Fund hold a substantial number of shares in the two Israeli banks. In addition, William Blair & Company, a Chicago-based global investment firm, has a strategic alliance with Poalim Capital Markets, a subsidiary of Bank Hapoalim. According to reports in the Israeli business daily Globes, Bank Hapoalim has expanded its operations outside of Israel through its Turkish subsidiary Bankpozitif Credi Ve Kalkinma Bankasi.

Like the companies involved in the Jerusalem light rail project and operating in Israel’s industrial zones built on occupied land, European and American investors in Bank Hapoalim and Bank Leumi should expect increased scrutiny and pressure from international human rights activists to divest their holdings.

Adri Nieuwhof is a consultant and human rights advocate based in Switzerland.